SX Coal

Published at

February 13, 2026 at 12:00 AM

China's mine-mouth thermal coal prices edge in narrow range

Low trading liquidity and minimal price fluctuations persisted across China's major thermal coal-producing regions, as most private mines and downstream factories closed for the Chinese New Year.

Mine-mouth supply constraints, worsened by early mine closures, met with waning demand, capping any significant upward potential. Some miners lifted offer prices modestly along with firmer portside prices.

According to Sxcoal's latest weekly survey covering 160 thermal coal mines in Shanxi, Shaanxi, and Inner Mongolia, 12.5% of the surveyed mines raised prices by an average of 15 yuan/t over February 5-11, while 13.75% cut prices by 18 yuan/t on average. For most mines, price changes remained marginal, calibrated to local offtakes.

Starting on February 5, private mines in Shaanxi began halting operations for the holiday, followed by many peers in Inner Mongolia from February 10. State-owned mines, meanwhile, would undergo 3-5 days of maintenance.

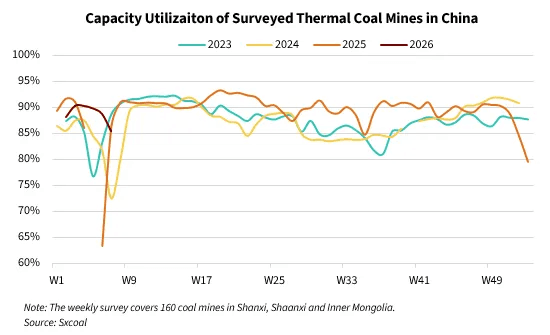

As such, the capacity utilization of Sxcoal-surveyed mines averaged 85.46% in the week ended February 11, down 3.28 percentage points from a week ago, hovering relatively low so far this year.

On the demand side, some chemical plants maintained on-demand purchases. Partial traders, buoyed by a recent rally at northern China ports, moved to secure cargoes ahead of the holiday. This lent brief support to prices in certain mining regions.

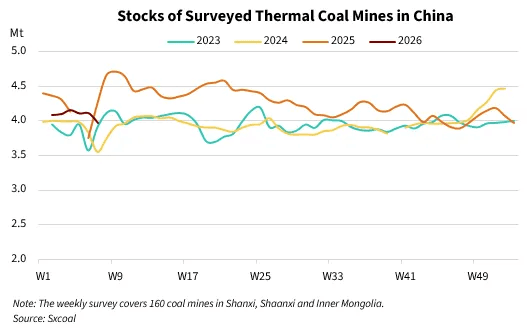

Ongoing essential offtakes, coupled with efforts to clear existing stocks, dragged down coal inventories at Sxcoal-surveyed mines to 3.97 million tonnes on February 11, 3.48% lower than the week-ago level.

A miner in Inner Mongolia's Ordos offered 4,900 Kcal/kg NAR mixed coal (S 0.6%) at 10 yuan/t higher to 390 yuan/t, mine-mouth with VAT, citing trucks sent by certain railway station-based traders.

However, without sustained end-user participation, such gains lack momentum. Both sellers and buyers are adopting a wait-and-see approach as the calendar rolls toward the holiday.

The demand-side fragility is most evident in the power sector. Even with a cold snap forecast to sweep across central and eastern China next week, bringing temperature drops of 4-8 degrees Celsius, most of China is expected to see average temperatures 1-3 degrees Celsius above seasonal norms over the next ten days.

Industrial power load has already retreated sharply as factories empty out for the festival. While residential heating may offer temporary support, the trajectory of coal consumption at power plants is decisively downward.

Daily coal burns at plants under six major coastal groups stood at 739,600 tonnes on February 11, down 8.9% week on week and 13.2% month on month, Sxcoal data showed. With existing stocks sufficient for 17.9 days of usage, these generators were in no rush to chase spot cargoes.

Moreover, with most logistics operators already halted, long-haul shipments also slowed down. Small, necessary purchases from some downstream users are less likely to offer sustained upward momentum.

In Shaanxi's Yulin, 6,239 Kcal/kg NAR washed coal (S 0.6%) slumped by 20 yuan/t to 640 yuan/t, ex-washplant with VAT. "Despite bullish portside cues, scarce demand still threatens mine-mouth offers," a local miner source confirmed.

On February 12, Sxcoal assessed Datong 5,500 Kcal/kg NAR coal and Yulin 5,800 Kcal/kg NAR grade at 572 yuan/t and 598 yuan/t, mine-mouth with VAT, both unchanged on the day. Ordos 5,500 Kcal/kg NAR material was also stable at 523 yuan/t.

Source:

Other Article

Liputan 6

Published at

1,76 Juta Metrik Ton Batu Bara Disebar ke 4 PLTU Jaga Listrik di Jawa Tak Padam

Bisnis Indonesia

Published at

10 dari 190 Izin Tambang yang Dibekukan Sudah Bayar Jaminan Reklamasi

IDX Channel.com

Published at

10 Emiten Batu Bara Paling Cuan di 2024, Siapa Saja?

METRO

Published at

10 Negara Pengguna Bahan Bakar Fosil Terbesar di Dunia

CNBC Indonesia

Published at