SX Coal

Tayang pada

4 Februari 2026 pukul 00.00

Monthly: China's Jan thermal coal prices fluctuate amid shifting supply-demand dynamics

China's thermal coal market fluctuated in January, as cold waves-induced rising coal consumption at power plants and consistent destocking at transfer ports met downstream resistance to high-priced cargoes, though overall prices increased compared to December.

December supply-demand summary

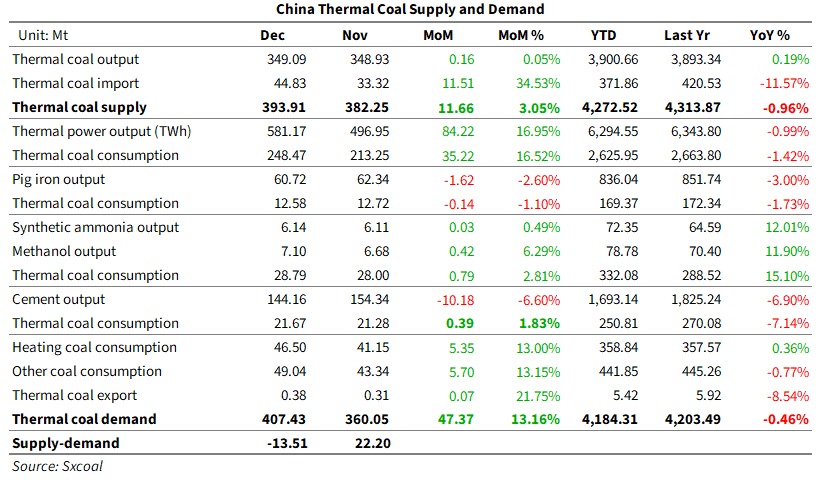

Supply The effective supply of thermal coal in China hit 393.91 million tonnes in December 2025, rising 3.05% month on month. This brought the total supply last year to 4.27 billion tonnes, down 0.96% year on year.

Demand Thermal coal demand was 407.43 million tonnes in December, rising 13.16% month on month. Total demand in the full year of 2025 was 4.18 billion tonnes, dipping 0.46% on the year.

In summary, the thermal coal market was in a shortfall of 13.51 million tonnes in December, compared to November's surplus of 22.20 million tonnes.

Production areas

Most mines ran normally across key thermal coal hubs. However, supply tightened slightly as some mines closed for the Chinese New Year holiday early. While miners adjusted prices slightly based on sales, those lifting offers increased in late January, backed by cold waves and portside price rebounds.

On the supply side, long-term contract supply across major producing regions stabilized during the winter supply guarantee period. Production resumed at mines suspending for the New Year holiday, driving up overall capacity utilization. With the Chinese New Year arriving relatively late this year, most mines planned shutdowns starting in February, with only a few in late January. Minimal snowfall also avoided significant disruptions to coal production and shipments. Overall supply hence hovered at medium-to-high levels.

Sxcoal's tracking data showed the weekly output of surveyed mines in the month to January 28 stood at 12.02 million tonnes, up 3.7% month on month and 5.6% year on year.

Mine inventories increased early in the month as production normalized entering 2026, but stabilized at moderate levels later amid steady shipments after improved market conditions post-holiday and diminished stocks at northern ports.

As of January 28, stockpiles at Sxcoal-surveyed thermal coal mines stood at 3.21 million tonnes, up 4.0% month on month and 8.6% on the year.

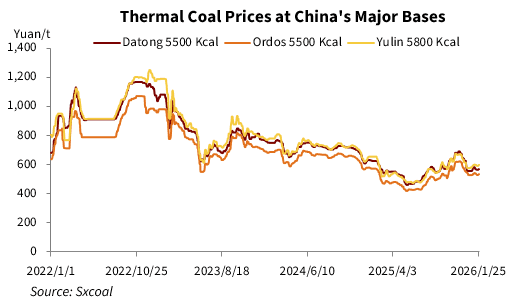

As of January 29, Shanxi Datong 5,500 Kcal/kg NAR thermal coal was assessed at 568 yuan/t, mine-mouth with VAT, rising 13 yuan/t from a month earlier. Inner Mongolia Ordos 5,500 Kcal/kg NAR coal was at 532 yuan/t, rising 7 yuan/t from the month before, and Shaanxi Yulin 5,800 Kcal/kg NAR thermal coal was assessed at 596 yuan/t, increasing 20 yuan/t month on month.

Transfer ports

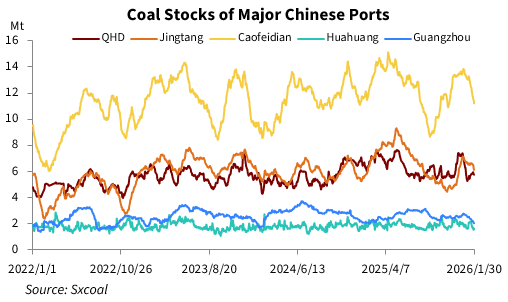

In January, portside coal inventories declined along with reduced supply and increased demand. Railway inflows to northern ports were constrained by high inventories and persistent congestion pressure, with Daqin railway maintaining a daily shipment of 1 million tonnes or so. Intensified cost pressure on port-bound coal shipments along with mine-mouth price rallies dampened traders' delivery enthusiasm in the first half of the month, consistently capping cargo inflows.

In the second half, a weakening market added to traders' wait-and-see sentiment. Outflows were initially curbed by falling coastal power plant consumption, sufficient coal stocks, and poor acceptance to pricier cargoes, as well as weather-related port closures in the Bohai Rim. However, outflows gradually recovered in late January, driven by cold air and pre-holiday restocking demand.

On January 30, coal inventories at the four Bohai ports of Qinhuangdao, Caofeidian, Jingtang, and Huanghua totaled 24.69 million tonnes, declining 13.29% month on month and 5.24% year on year. Coal stocks at Qinhuangdao stood at 5.73 million tonnes, retreating 8.47% on the month and 8.03% on the year.

On January 30, Guangzhou port held 2.06 million tonnes of coal, diving 24.4% from the month-ago level and 1.7% from the previous year. Milder weather in southern China reduced coal consumption at local power plants. Resilient prices for both Chinese domestic and imported thermal coal in the first half depressed procurement appetite, while tight import supplies later contributed to falling inventories by the month-end.

Overall coal burns at power plants hovered high, supported by growing heating demand alongside colder weather, stable industrial use, and pre-holiday restocking. Non-power sectors remained in their off-season production period, offering little demand support. Steady supply recovery and minor demand growth capped portside price rallies. Port inventory drawdowns also eased the downward pressure on prices.

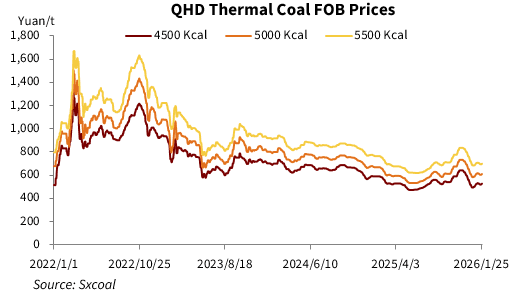

Throughout January, portside prices fell moderately after rising in the first half, before rebounding slightly in the last week, fueled by rising mine-mouth prices, cold waves, pre-holiday demand release, and firm imported coal prices.

As of January 29, 5,500 Kcal/kg NAR thermal coal traded at Qinhuangdao port reached 695 yuan/t, FOB with VAT, rising 15 yuan/t from the month before.

At southern China's Guangzhou port, Shanxi premium mixed 5,500 Kcal/kg NAR coal with 0.6% sulfur fell 25 yuan/t month on month to 755 yuan/t, ex-stock with VAT, dragged down by insignificant cold spell impact, high inventories, and import coal.

Import market

Contracted supply significantly underpinned overseas low-CV coal prices, narrowing their price advantages compared to domestic equivalents. Mid- and high-CV coal prices tracked with the domestic market, maintaining a stable price edge.

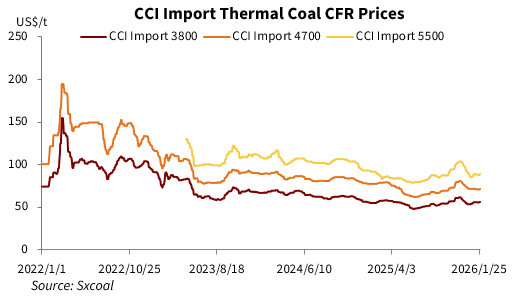

As of January 29, the CCI index for imported 5,500 Kcal/kg and 3,800 Kcal/kg NAR coal stood at $88.5/t and $56.0/t CFR, respectively, rising $4/t and $2.5/t from a month ago, while 4,700 Kcal/kg NAR material remained unchanged at $72.0/t CFR.

Consuming area

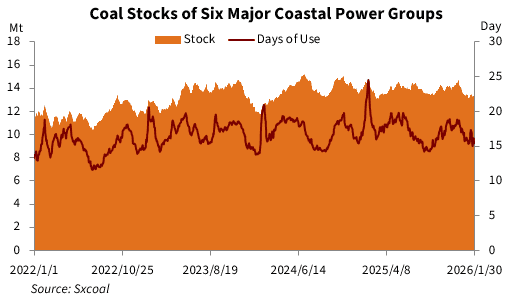

Following the New Year's Day holiday, a brief jump in coal consumption, coupled with northern port closures, led to a decline in fuel inventories at power plants. After consumption retreated from the peak level, inventories stabilized briefly before falling again in the wake of month-end cold waves.

As of January 30, coal stocks at power plants of the six coastal power groups totaled 13.13 million tonnes, falling 2.12% from a month ago and 8.93% year on year. Their daily coal consumption gained 2.28% month on month to 854,000 tonnes, which was up 29.98% compared with the year-ago level.

The stocks were enough to cover 15.4 days of use at these power plants, 0.7 day shorter than the previous month and falling 6.6 days from the year-ago level.

January highlights recap

As the Chinese New Year approached, safety inspections were intensified nationwide, with a key focus on mine safety. The Work Safety Committee of the State Council issued a notice urging strict implementation of safety measures, in a bid to prevent and curb serious accidents.

The National Mine Safety Administration summarized six common winter hazards in open-pit mines and corresponding preventive measures. Regional authorities, including Ningxia and Anhui, held meetings to enforce safety responsibilities and technological improvements.

Provincial energy work conferences outlined directions for 2026. Shanxi emphasized boosting both the scale and value of the coal industry, ensuring stable supply, increasing advanced capacity, developing intelligent mines, and prompting the integrated development of coal and new energy. Shaanxi focused on stabilizing and increasing energy output, while Inner Mongolia prioritized high-quality planning for its energy sector during the 15th "Five-Year Plan" period.

Listed coal companies released their 2025 performance forecasts, revealing narrowing profits and an increase in loss-making firms. China Coal Xinji Energy Co., Ltd. predicted a 13.73% year-on-year drop in 2025 net profit, while Huaibei Mining Holdings could see a 69.21% slide.

Sumber:

Artikel Lainnya

Liputan 6

Tayang pada

1,76 Juta Metrik Ton Batu Bara Disebar ke 4 PLTU Jaga Listrik di Jawa Tak Padam

Bisnis Indonesia

Tayang pada

10 dari 190 Izin Tambang yang Dibekukan Sudah Bayar Jaminan Reklamasi

IDX Channel.com

Tayang pada

10 Emiten Batu Bara Paling Cuan di 2024, Siapa Saja?

METRO

Tayang pada

10 Negara Pengguna Bahan Bakar Fosil Terbesar di Dunia

CNBC Indonesia

Tayang pada